Insurance Coverage Restricts Not Adequate To Cover Case?

When obtaining vehicle insurance quotes, I suggest asking how much you can conserve by enhancing the deductible. I would certainly recommend seeing if having a $1,000 deductible rather than $500 would conserve enough to make it worth your while. A DUI typically raises your car insurance coverage prices for 3 to five years, depending on your state. By age 70, senior chauffeurs are paying an average of 11% greater than they were at age 60.

State minimal protection rates mirror the minimum amount of automobile insurance coverage required in each state. Insurance companies likewise review various other elements such as gender, age, profession, marriage status, home ownership and credit report. For instance, California, Hawaii, Massachusetts and Michigan ban the use of credit rating in car insurance quotes. You'll pick a deductible quantity-- the amount your insurance firm subtracts from a claim check-- when you acquire accident and comprehensive insurance policy. A $500 insurance deductible is the most typical option, yet you can save money by raising your cars and truck insurance coverage deductible. Our analysis located that the typical cars and truck insurance coverage rate rise for motorists with a drunk driving is 71%.

How Do I Make An Uninsured Driver Claim?

If it works, the very best remedy to uncovering the at-fault motorist's plan restrictions is merely to ask the various other motorist to see if they'll give the info. If they have actually been instructed Auto accident lawyer for insurance disputes not to speak with you by their adjuster, attempt asking the insurance adjuster. However, insurance provider are not usually needed to disclose policy limitations in responsibility claims upon demand.

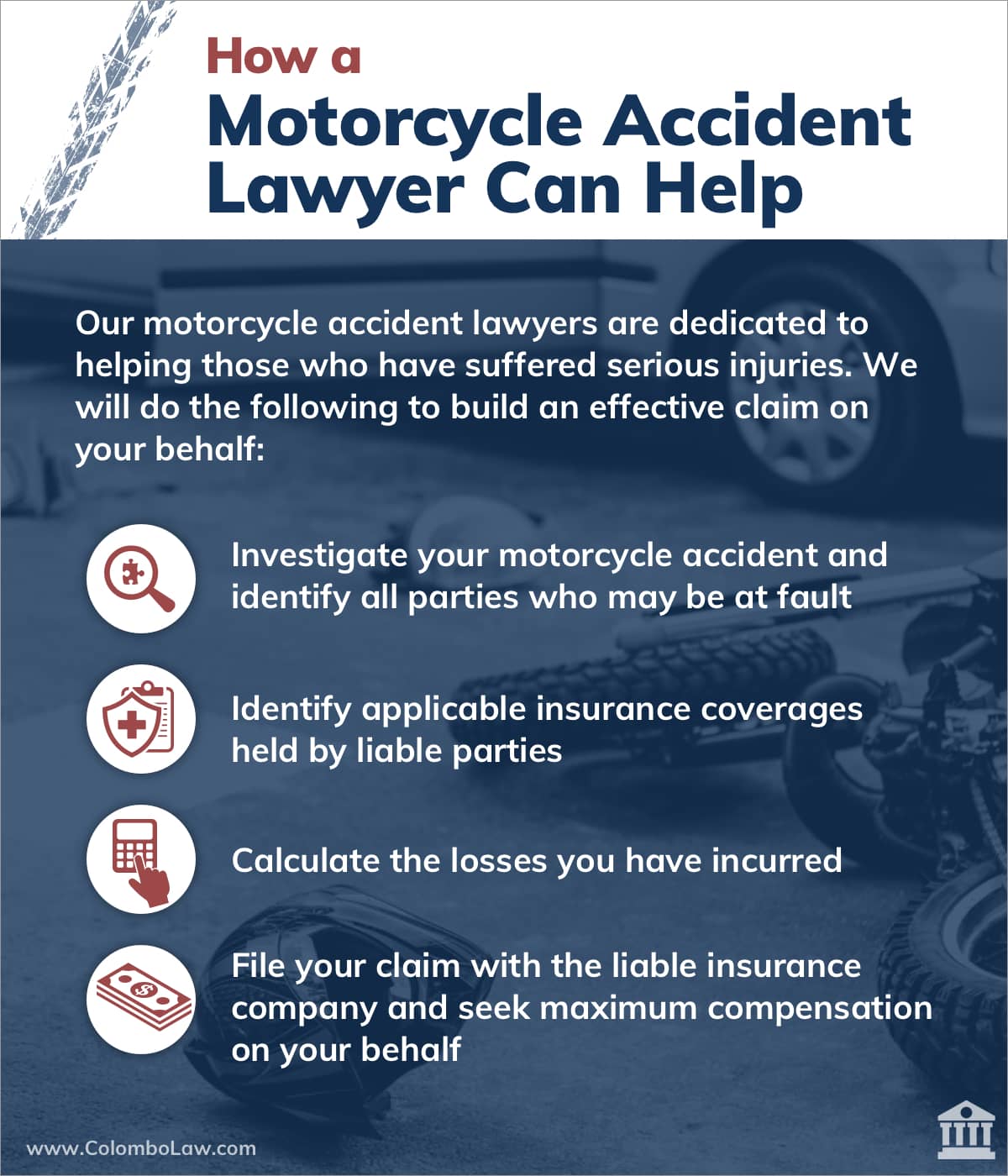

Lawyer's Method

- Consulting a cars and truck accident lawyer from the Regulation Offices of Robert E. Brown, P.C.It's generally wise for cars and truck accident victims to get local lawful assistance.Many insurance provider restrict the amount of time insurance holders need to make uninsured motorist and underinsured driver cases (usually it's as couple of as one month from the date of the crash).An underinsured vehicle driver insurance claim will typically take a little bit longer to develop, at the very least till your clinical treatment advances and you obtain an understanding of the value of your automobile accident case.

It normally covers medical expenses, lost incomes, and other problems that the at-fault vehicle driver's insurance coverage would certainly have paid if they had coverage. Recognizing North Carolina's insurance coverage demands and the protection you lug is vital after an automobile accident. Without without insurance vehicle driver or underinsured vehicle driver insurance coverage, you may need to cover clinical therapy, car damage, and lost earnings on your own. It's important to inspect your cars and truck insurance policy and see to it you have ample insurance coverage. An experienced car crash attorney can help you understand your lawful choices and fight for the settlement you deserve. Without insurance motorist insurance policy protection (UM insurance coverage) secures you when the various other motorist has no insurance policy protection.

Compare Automobile Insurance Prices For Motorists With An At-fault Crash

That means one in 8 motorists sharing the roadway with you does not have vehicle insurance policy. If you have health insurance, make certain your clinical providers file your costs with your health and wellness insurance provider. In a similar way, you might call any kind of medical service provider with whom you have an outstanding equilibrium and make the exact same request. Many wellness insurers and healthcare facilities will certainly supply a significant reduction when they find out there is a restricted amount of car insurance policy money available.

If you have actually been involved in a crash with an underinsured chauffeur, don't deal with the insurance companies alone. Obtain a cost-free case analysis today to review your instance with a skilled personal injury legal representative. We can assist you check out all available choices for settlement and make sure that you receive the financial healing you are entitled to. Winning a lawsuit versus an uninsured at-fault chauffeur does not ensure instant repayment. Courts might issue a judgment for damages, but implementing that judgment needs extra legal actions.

Losing your permit makes it tough to get to function, institution, or do vital duties. You might likewise need to spend for the medical therapy of others involved in the crash. A knowledgeable personal injury lawyer can check out these possible sources of payment to guarantee you receive the maximum amount readily available. Your injury lawyer can assess whether submitting a legal action is a useful choice in your case. These restrictions may not be enough to cover all expenses in a severe mishap. If the at-fault vehicle driver's plan is worn down before all costs are paid, you could be stuck holding unpaid medical expenses and repair work expenses. If you locate on your own in an automobile accident as a result of the carelessness of an additional motorist, you might depend on their insurance policy to cover the expenses related to damages or injuries. However, the level of the crash may lead to significant costs for you. In such cases, the Multi-car pileup insurance policy of the at-fault driver can aid in covering a significant section of these expenses. Nevertheless, if the chauffeur in charge of the mishap has inadequate or no insurance coverage, you may question the offered choices.