What Happens If The At-fault Driver Has Inadequate Insurance Coverage To Cover All My Damages?

The minimum needed coverage is $25,000 per person and $50,000 per crash. This coverage is compulsory for all vehicle insurance coverage in New york city. This insurance coverage handles clinical costs, shed wages, and other losses when the at-fault event lacks sufficient insurance coverage.

- Accident attorneys have the sources and experience to compile this evidence successfully and construct a strong situation that accurately mirrors the influence of the accident on your life.Without insurance coverage, a motorist lacks financial backing, making complex crash claims.If settlement is postponed or denied, thorough documents increases the chances of a successful allure or lawsuit.When you remain in an automobile accident brought on by another motorist, you expect their insurer to spend for problems.While much less common, some states impose jail time for uninsured drivers, especially in cases of duplicated offenses or when an uninsured driver triggers a significant accident.

She belongs to North Carolina Supporters for Justice, has executed for the public good benefit the Southern Coalition for Social Justice, and has actually offered with Partners for Young People Chance. Before signing up with the firm, Cristen operated in governing events researching proper compliance by insurers. She additionally examined customer problems and conducted study for instances under the Customer Sales Practices Act. Whether or not you can discover success by suing the at-fault vehicle driver mostly depends on the negligent motorist actually having any type of money.

Having the right vehicle insurance policy coverage, like uninsured/underinsured motorist insurance coverage, can assist. If you have endured tragic injuries and need ongoing treatment, an underinsured chauffeur's plan may not be able to aid you. The various other circumstance is when the underinsured vehicle driver's policy is not enough to cover your car repair services. In such instances, the simplest option is to have underinsured or uninsured insurance coverage from your insurer. This insurance coverage is provided at an extra charge and caters for mishaps involving uninsured or underinsured motorists.

Your Automobile

Uninsured or underinsured vehicle driver coverage can spend for repairs, clinical costs, and various other problems. If you don't have this coverage, you can take legal action against the at-fault chauffeur to try to get compensation. If you have uninsured driver protection or underinsured motorist insurance coverage on your plan, it can assist. It covers costs like repair work, medical costs, and damages when the various other motorist does not have insurance. Being in a crash with a without insurance chauffeur can have significant effects, even if you're not at fault.

Why Insurance Coverage Needs Matter After An Accident

In addition to getting your permit and registering your car, you need to choose the ideal auto insurance. Having proper protection ensures you're monetarily protected if a mishap takes place. If legal action needs to be taken versus the irresponsible chauffeur, talk to among the relied on vehicle accident legal representatives in Maine at Hardy, Wolf & Downing. With a well-earned track record of integrity and professionalism, the highly-credentialed lawyers at Hardy, Wolf & Downing exist to aid you with fixing a problem or submitting an UM case if needed. Appropriate paperwork is vital in supporting a claim after a mishap.

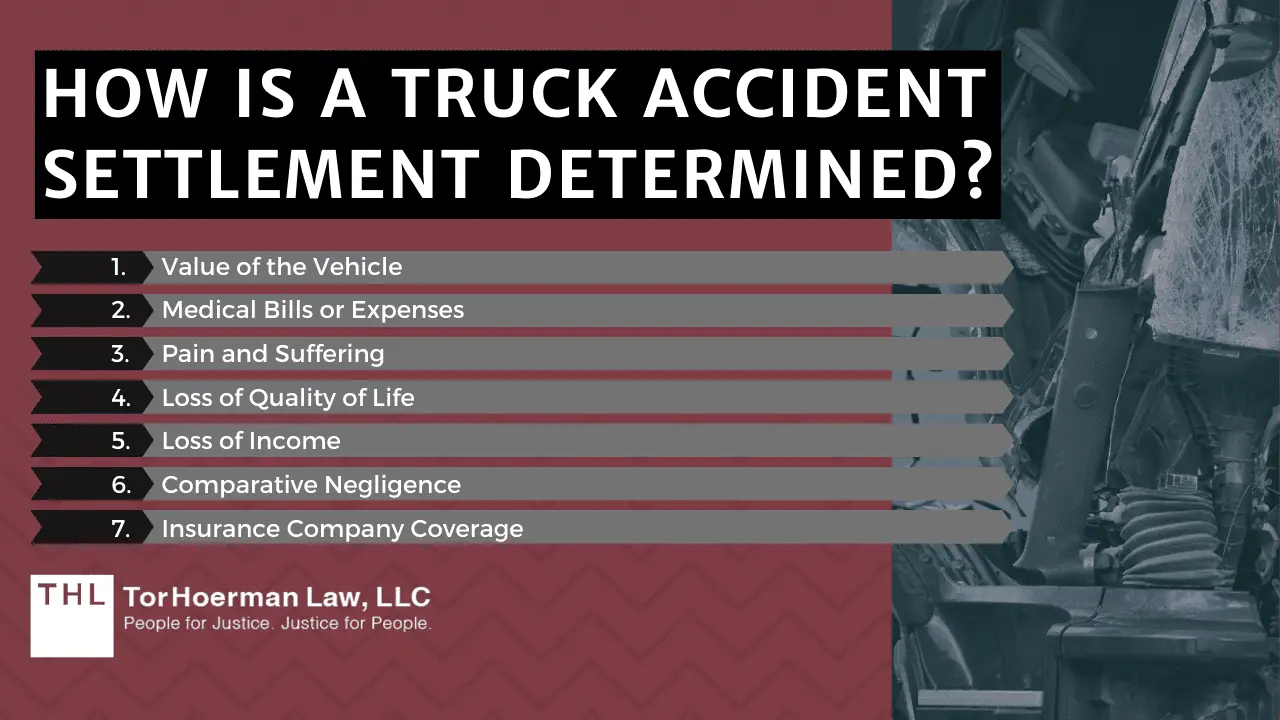

Clinical therapy alone can set you back from a couple of thousand dollars to hundreds of countless bucks for surgical treatments, recovery, and lasting treatment. Generally, repairs to a car can range from $5,000 to Steering Malfunction $20,000, relying on the damage done. If your injuries are maintaining you from functioning, lost incomes can be an additional large financial problem.

Get In Touch With A Personal Injury Legal Representative

This is why chauffeurs in no-fault accident states are still required to lug obligation vehicle insurance policy protection. If the at-fault vehicle driver's insurance coverage will not cover your losses, there are a Personal Injury Lawyer few various paths you can require to get the remainder. One prominent repair is uninsured/underinsured motorist (UM/UIM) insurance. If you have this coverage on your policy, your insurer can cover added expenses that the other motorist's insurance coverage does not pay. In every situation, our task is to recoup the optimum settlement offered to you.